Calgary Real Estate Market Shifts

Here’s a curated visual carousel to elevate your post:

Edmonton Rental Trend (1 BR): Clear upward rental trajectory in Edmonton.

Calgary Rental Trend (1 BR): Calgary’s rents showing upward momentum.

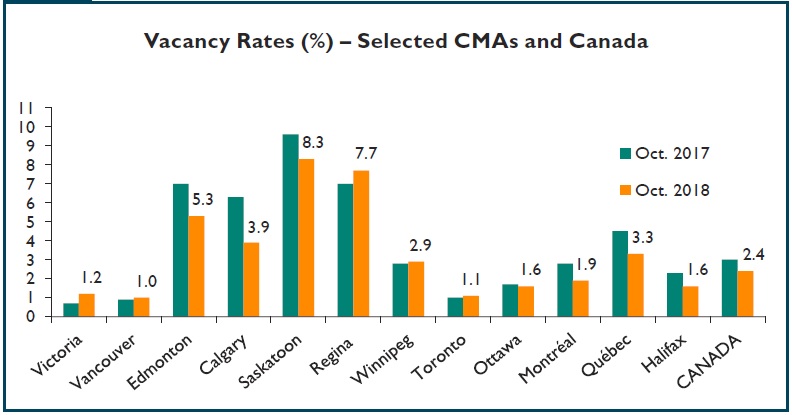

Vacancy Rates Bar Chart: Highlights tight rental markets in both cities.

Edmonton Average Rent by Sector: Breakdown by neighborhoods to show pricing variation.

Social Media Post Draft

Headline:

Rental Demand Skyrockets in Alberta—Strong in Calgary, Even Stronger in Edmonton!

Body Copy:

The Alberta rental scene is buzzing—and it’s not slowing down. The Calgary Herald confirms: “Rental demand remains strong in Calgary—and even more so in Edmonton.” https://www.calgary.ca+14X (formerly Twitter)+14X (formerly Twitter)+14New Homes AlbertaReddit

Here’s why this market is turning heads:

Calgary’s rent growth stays solid: Despite a slight slow-down, Calgary still posted ~8% year-over-year rent growth in Q1 2024.Yahoo News

Edmonton is outpacing Calgary: Demand in Edmonton is notably even stronger—driving rents higher and vacancy rates lower.Wikipedia+14X (formerly Twitter)+14Yahoo News+14

Tight rental market persists: Vacancy stubbornly low, with both cities seeing high occupancy and limited supply.Yahoo News

Why this matters:

Urban professionals, families, and newcomers—you’ll find vibrant living options in Calgary.

If affordability and opportunity matter most, Edmonton is delivering with even fiercer demand and strong value.

Suggested Visuals to Include:

Use Calgary and Edmonton rental trend charts (first and second images) to immediately show rising rents.

The vacancy comparison bar chart (third image) highlights how tight supply remains.

The neighborhood breakdown for Edmonton (fourth image) adds granular insight for location-savvy viewers.

Call to Action:

Whether you're scouting for a new home or tracking market trends—now’s the moment to watch these cities. Dive into the full Calgary Herald article for deeper insights.

Why This Works

Timely Lead: Ties to a trusted local outlet (Calgary Herald) to boost credibility.

Stat-Driven: Anchored by specific, compelling figures (like 8% rent growth).

Visual Storytelling: Graphs capture attention and clarify complex data instantly.

Broad Appeal: Relatable to both renters and real estate followers—points to both demand and economic vitality.

Engaging Format: Clean structure with bold call-to-action for deeper engagement.

most recent and popular real estate trends, listings, and market insights in Calgary, Alberta, Canada, as of mid-2024

1. Current Market Trends & Insights

Strong Demand & Rising Prices: Calgary’s real estate market remains highly competitive, with rising demand due to interprovincial migration (especially from Ontario and BC) and relative affordability compared to other major Canadian cities.

Low Inventory: The supply of homes remains tight, particularly for single-family detached homes, leading to bidding wars in popular neighborhoods.

Price Growth: The benchmark home price in Calgary reached ~$570,000 (up ~10% YoY), with detached homes averaging ~$700,000 and condos around ~$300,000.

Rental Market Boom: High demand for rentals has pushed average rents for a 1-bedroom apartment to ~$1,800/month.

2. Popular New Listings & Key Developments

a) Luxury & High-Demand Listings

Crescent Heights (Downtown Adjacent): A newly listed 3-bed, 3-bath modern townhome priced at $1.2M, featuring rooftop terraces, smart home tech, and mountain views.

Aspen Woods (West Calgary): A 5,200 sq.ft. estate listed at $2.8M with a home theater, wine cellar, and panoramic Rockies views.

East Village (Urban Living): New luxury condo towers (e.g., The Concord) offering high-end finishes, starting at $600,000 for 1-bed units.

b) Affordable & Family-Friendly Listings

Airdrie (Near Calgary): New townhome developments from $450,000, attracting young families.

Seton (Southeast Calgary): A newly built 4-bed detached home for $750,000, close to schools and shopping.

3. Key Amenities Driving Demand

Proximity to Transit (Green Line LRT expansion)

Walkability & Urban Revitalization (Beltline, East Village)

Energy-Efficient & Smart Homes (Solar-ready builds, EV charging)

Access to Nature (Near Fish Creek Park, Bow River pathways)

4. Expert Opinions & Forecasts

Price Growth to Continue: Experts predict 5-8% annual price increases in 2024-2025 due to sustained demand and limited supply.

Condos Gaining Popularity: First-time buyers and investors are turning to condos as detached homes become less affordable.

Interest Rate Impact: If the Bank of Canada cuts rates in late 2024, demand could surge further.

Commercial & Mixed-Use Growth: Downtown office conversions to residential units are expected to boost inner-city living.

Conclusion

Calgary’s real estate market remains a seller’s market, with strong demand for single-family homes, luxury properties, and well-located condos. Buyers should act quickly, while investors see long-term potential in Calgary’s growing economy and population.

Would you like details on specific neighborhoods or investment opportunities?

Calgary's Real Estate Market Shifts to a Balanced State in July 2025, Presenting New Opportunities for Buyers

Calgary's housing market has entered a balanced state for the first time in years. This change, noted in July 2025, comes with a significant increase in available homes and a slowdown in sales activity. Buyers now have more negotiating power and a wider selection of properties.

After a long period of high demand and rising prices, the market is clearly cooling down. In June, active listings rose by 83% compared to the same month last year, reaching levels not seen since before the population boom of 2022. This increase in available homes coincided with a 16.5% year-over-year drop in sales, suggesting a more typical market.

The benchmark price for all residential properties in Calgary dipped slightly to $586,200, a 3.6% decrease from June 2024. The decline is more pronounced in the apartment and row home sectors, which have seen year-over-year price drops of over 3%.

Key Market Indicators for July 2025:

Average Home Price: The average home price in Calgary for June 2025 was about $646,147, reflecting a 3.7% increase from the previous year. However, some sources list a composite benchmark price between $586,200 and $587,400.

Sales and Inventory: Home sales in June fell by 16% year-over-year, with 2,286 units sold. Meanwhile, new listings rose by 11% year-over-year, with 4,223 new properties hitting the market. This increase pushed the months of supply to over three months, indicating a balanced market. The sales-to-new-listings ratio was 54% in June, supporting the assessment of a balanced market.

Days on Market: The average time a property remains on the market has risen to 33 days, nearly a 68% increase from the previous year.

Performance by Property Type:

Detached Homes: The detached home sector is stable, with the benchmark price at $764,300, a slight 0.4% lower than last year. The average price for a detached home in June was about $819,909, showing a small annual decline of 1.1%.

Semi-Detached Homes: This segment has shown strength, with a small price increase. The benchmark price for semi-detached homes reached $696,400, up 1.5% from 2024. The average price also rose 5.4% year-over-year to $701,429.

Townhomes: Townhome inventory has more than doubled, and the benchmark price has dropped by roughly 3% to $450,300.

Apartments and Condos: The apartment sector now favors buyers, with nearly four months of supply. The benchmark price for an apartment has fallen 3.3% year-over-year to $333,500. This segment has been particularly affected by a drop in migration to Calgary.

What's Driving the Shift?

Several factors are affecting the current market dynamics. An influx of buyers from provinces with higher prices, like Vancouver and Toronto, continues to support some demand. Strong job growth in sectors such as tech and logistics is also attracting new residents to the city. However, the sharp rise in new listings is outpacing sales, leading to increased competition and giving buyers more options.

Looking Ahead:

For the rest of 2025, experts expect inventory to keep growing, especially for properties priced under $500,000. Negotiation is likely to become a regular part of buying a home. While the overall market is cooling, quality properties in desirable areas are still expected to sell well. This shift to a more balanced market is seen as a healthy and sustainable change for the long-term future of Calgary's real estate sector.